Lasvur.ru - Материалы для парикмахеров. Материалы для ногтей. Профессиональные инструменты.

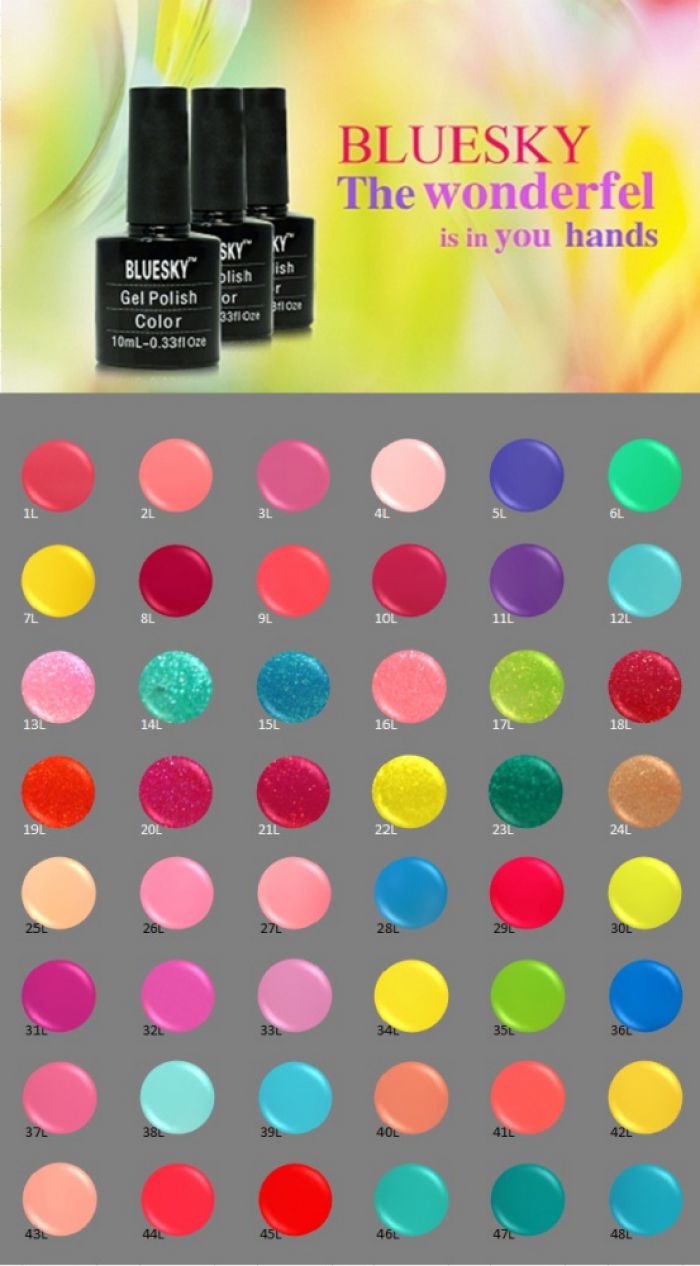

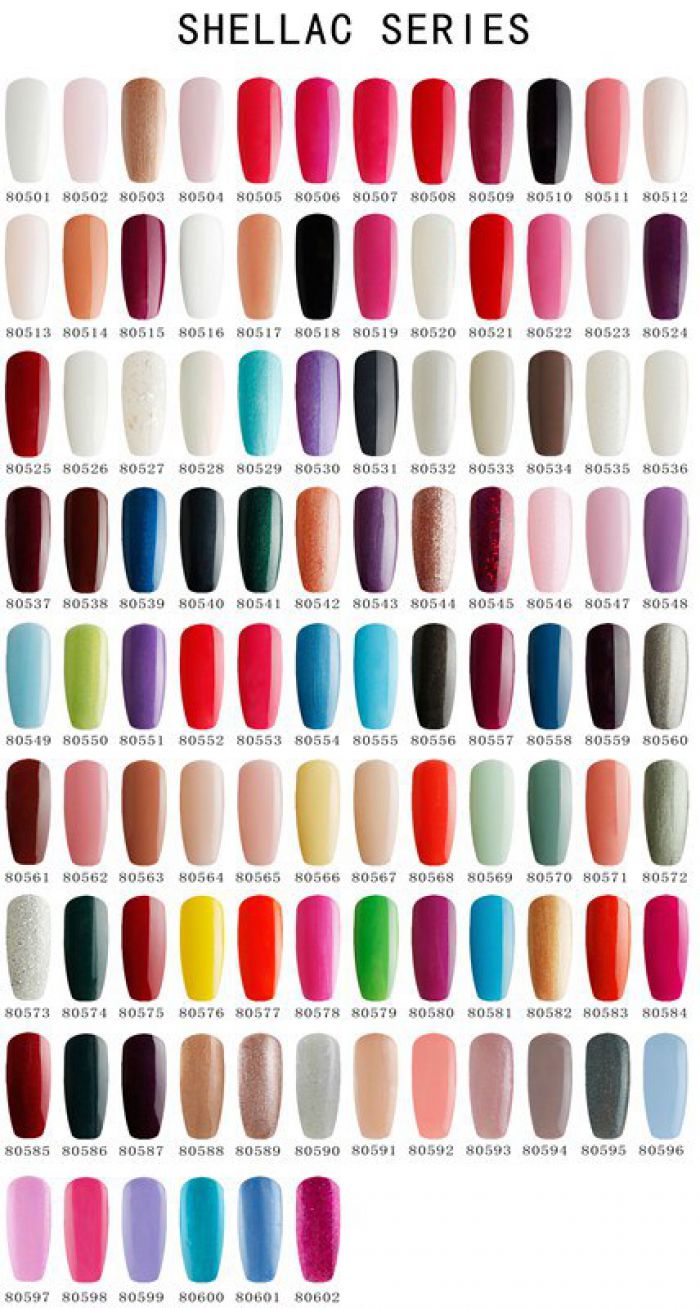

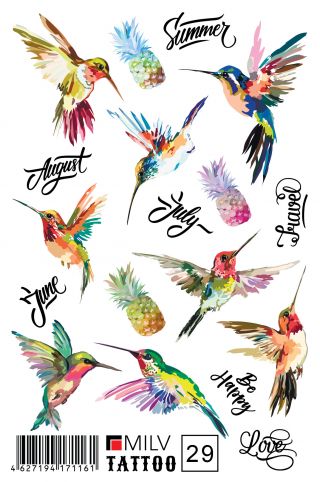

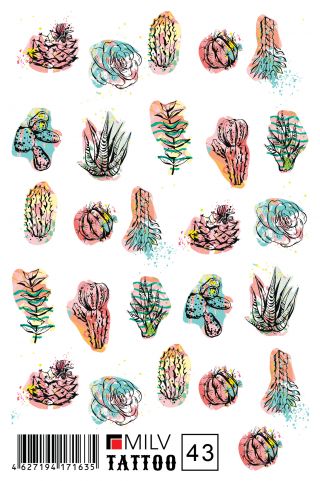

Материалы для парикмахеров. Материалы для ногтей.

Профессиональные инструменты

Профессиональные инструменты

LOGIN

Войти или зарегистрироваться

Вы у нас впервые?

Зарегистрируйтесь сейчас! Это совершенно бесплатно. Делайте приятные покупки вместе с нами!

1000 руб.

минимальный заказ